Recover Every $$$ Owed from Insurance -Faster & Cheaper

Insurance Claims Experts for 30+ Years

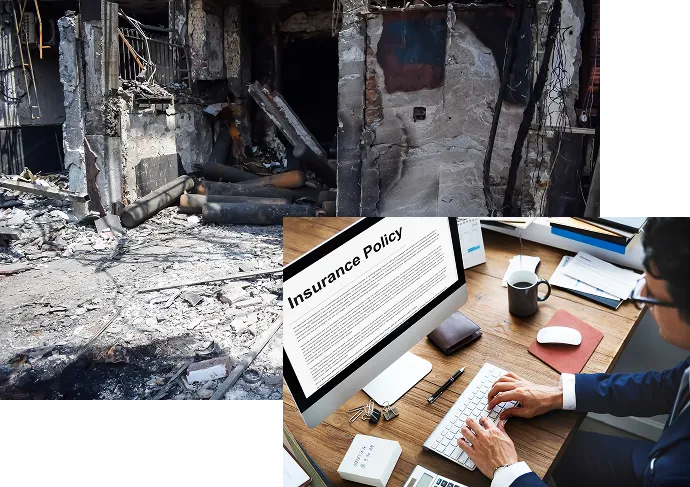

Increase your Insurance Claim Payout:

Get more money, quickly

Maximize your Property Insurance Claim

Experience & Documented Success for fire claims

12.6x Avg Claim Payout Increase for our clients

No upfront cost - only pay if we win your case

Call Now:

We work with all insurance companies: We negotiate directly with you insurance so you don’t have to

+ many more...

Services

Residential Insurance Claims

Your home is more than just a building—it is where you make memories. If a disaster damages your home, such as a fire, water leak, or roof damage, we will help. We carefully document all damages to make sure you get the full payment you deserve.

Commercial Insurance Claims

Businesses can suffer big losses due to disasters like fires or floods. Our adjusters help companies get the highest possible insurance payout. We assist with property damage and business interruption claims, so you can focus on reopening and moving forward.

Catastrophe Claims

When large-scale disasters strike—like hurricanes, wildfires, or floods—insurance companies are flooded with claims and may rush or undervalue payouts. We ensure your catastrophe claim gets the attention it deserves with detailed documentation, skilled negotiation, and a relentless focus on your recovery. We fight to secure the full value of your policy so you can rebuild with confidence.

Why Choose Independence Claims?

Expert Guidance

Insurance policies can be confusing. Our team understands all the complicated terms and makes sure the insurance company follows its promises.

Higher Payouts

Insurance companies often pay less than you deserve. We negotiate aggressively to make sure you receive the full amount stated in your policy.

No Recovery, No Fee

We work on a contingency basis, which means you don’t pay us unless we win your claim. If we don’t recover money for you, you owe us nothing.

Complete Documentation

Strong claims need strong evidence. We collect photos, reports, and other proof to make sure your claim is successful.

Stress-Free Process

Filing a claim can be overwhelming. We take care of everything, from paperwork to negotiations, so you can focus on rebuilding your home or business.

How Our Claims Process Works

We follow a simple and structured process to ensure you get the best results:

Step 1: Free Consultation & Policy Review

We start with a free consultation, where we review your insurance policy. Many people do not know what their policy covers. Our experts check every detail to find out how much money you can claim.

Step 2: Damage Inspection & Documentation

We visit your property to inspect the damage and collect evidence. Unlike insurance company adjusters, who try to reduce payouts, we work only for you. We document all damages with high-quality photos, videos, and expert reports.

Step 3: Filing & Negotiation

Filing a claim is difficult. A small mistake in your paperwork can cause delays or even a claim denial. Our team prepares all documents and handles communication with the insurance company. We negotiate for the highest possible settlement.

Step 4: Settlement & Payment

Insurance companies often delay payments. We push for a quick and fair settlement, so you receive your money without unnecessary waiting. If there are disputes, we fight to make sure you get every dollar you deserve.

Step 5: 24/7 Support

We are available all day, every day to assist you. Whether you need immediate help after a disaster or have questions about your claim, we are here for you.

712% Average Payout Increase:

Get the Full Payment you Deserve

Our public adjusters excel at settling denied claims and increasing settlement amounts for both residential & commercial claims.

Residential Claims

We specialize in helping homeowners with insurance claims, especially when claims are denied or the offered amount isn't enough to cover repairs. Our team works hard to negotiate fair settlements, ensuring homeowners get the money they need to fix their homes.

Commercial Claims

We specialize in commercial insurance claims, when business owners face denials or insufficient offers that can disrupt operations and income. With a team of engineers, adjusters, and estimators, we ensure fair settlements, minimizing business disruptions and financial impacts.

How I Work

Experience My Uniqueness

Over 30+ years, our proven process has helped thousands of victims fight insurance roadblocks to secure the full compensation needed quickly.

1

Thorough Documentation

I provide clear and accurate documentation to ensure insurance companies can make fair decisions.

2

Expert

Analysis

My deep knowledge and experience of policy coverage, construction, and industry standards allow us to assess claims effectively.

3

Clear

Communication

I explain complex issues in simple terms, facilitating understanding between all parties involved.

4

Fair & Fast Settlement

Assessments & Reports backed by facts that can’t be rejected by carriers. Quick turn around so you claim is not dragged out

97% Success Rate:

Settle your claim for maximum compensation

On average, our clients receive a 712% larger payout on their insurance claims

With a 97% success rate, our public adjusters excel at settling denied claims and increasing settlement amounts.

Our expertise in thoroughly understanding your policy and providing accurate estimate documentation ensures you receive the compensation you deserve.

This turns frustrating claim rejections into fair and satisfactory outcomes.

Proven Success in Insurance Claims: Real Case Studies, Real Results

Fire Damage

with Travelers

Other Attorney

$214,872

Claim Warriors

$418,317

“Claim Warrior was a lifesaver stepping into navigate the fire damage claim when the insurance representative was unresponsive and evasive.”

Danny A.

Roof Damage

with Progressive

Other Adjuster

$4,295

Claim Warriors

$51,618

“Claim Warrior proved storm damage caused roof issues. countering the insurance claims of contractor error, and getting me a fair settlement to repair my roof.”

John W.

Water Damage

with Allstate

Original Settlement

DENIED

Claim Warriors

$114,473

“Insurance company initially offered too little and didn’t want to pay. Claim Warrior helped me get fair compensation for water damage from a pipe burst.”

Kelly P.

Know Your Insurance Rights

Many people do not realize that insurance companies often undervalue claims. You do not have to settle for less. Our insurance public adjusters fight to make sure you receive the full compensation you deserve.

What types of storm damage do you handle?

We assist with claims for wind, hail, hurricanes, tornadoes, roof damage, flooding, and other storm-related losses.

How long does the claims process take?

The timeline depends on your case, but we work efficiently to get your settlement as quickly as possible.

What if my insurance claim was denied?

We can review your denied claim, find the issues, and appeal the decision with stronger evidence and negotiation tactics.

5,000+ Happy Customers and Counting:

Real Stories of Success with SPJ Adjusting

“SPJ Adjusting Services helped me navigate a complicated insurance claim and get the compensation I deserved. I highly recommend their services.”

AaronTaylor

Baltimore, MD

“The team at SPJ Adjusting Services was professional and knowledgeable. They helped me explain to my insurance why certain items in our claim was required and got a payout for it"

Jane Doe

Chicago, IL

“Mr Jerome does not argue, rather document and explain things to the insurance. That made all the difference”

Mike Johnson

Charlotte, NC

FAQ

When should I hire a public adjuster?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

How does Claim Warrior get paid?

We work on a contingency fee basis, which means we receive a percentage of the final insurance settlement. This fee is agreed upon before they begin work on your claim.

Why should I choose a public adjuster over handling the claim myself?

Public adjusters bring specialized expertise in insurance policies, claims procedures, and negotiation tactics. They can often secure higher settlements than policyholders can negotiate on their own, and they handle all the complexities of the claims process, saving you time and reducing stress.

What if I've already received a settlement offer from my insurance company?

Even if you’ve received a settlement offer, a public adjuster can review it to ensure it adequately covers all damages and losses. They can negotiate with the insurance company for a higher settlement if necessary.

Toll Free +1 (833) 573-9492

© 2025 Independence Claims Services • All Rights Reserved