About

Independence Claims is dedicated to helping homeowners and business owners navigate the insurance claims process and receive the maximum compensation for their losses. Our experienced public adjusters advocate for policyholders when insurance companies undervalue or deny claims. Whether it’s property damage due to storms, fire, water leaks, or other disasters, we work diligently to ensure fair treatment and just settlements.

With a deep understanding of insurance policies and negotiation strategies, our team fights for your rights so you don’t have to settle for less than you deserve. At Independence Claims, we believe in fairness, transparency, and delivering results that make a difference in your recovery.

We Work in 32+ States

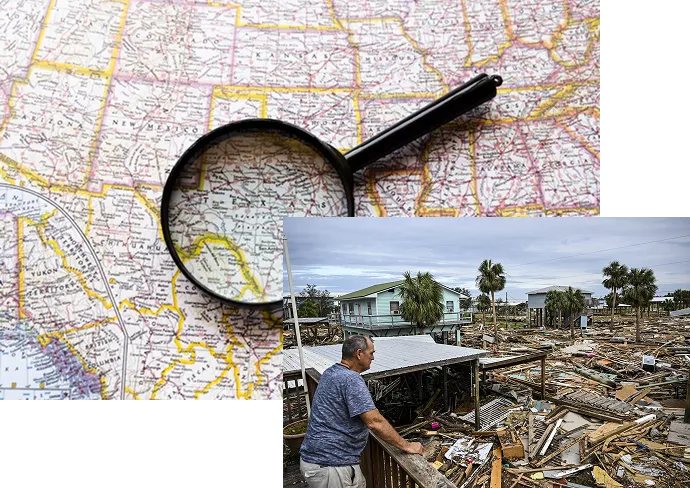

After a storm, many people trust their insurance company to pay what they deserve. Unfortunately, insurers often try to reduce their payouts or deny claims for technical reasons. This is where a public adjuster becomes essential.

A public adjuster works for you, not the insurance company. Unlike the insurance adjuster sent by your provider, we focus on getting you the highest possible settlement. We make sure all damages—whether from wind, hail, flooding, or roof damage—are properly documented. Our goal is to secure the compensation you need to rebuild.

Without expert help, you might receive much less than you should. We understand how to navigate complex insurance policies and ensure your claim is filed correctly, backed by strong evidence, and supported by expert negotiations. This greatly increases your chances of receiving a higher payout.

Texas

With extreme weather conditions such as hurricanes, flooding, and wildfires, Texas property owners often face challenges when filing insurance claims. Whether you’re in Houston, Dallas, Austin, or San Antonio, our adjusters provide expert assistance to maximize your claim payout.

Maryland

In Maryland, storm damage and flooding are common challenges for homeowners. We help clients in Baltimore, Annapolis, and surrounding areas secure the highest possible settlements for their insurance claims.

Virginia

Virginia residents dealing with hurricane damage, burst pipes, or roof leaks can count on our experienced team. We navigate the complexities of insurance claims so you can focus on restoring your property without financial stress.

District of Columbia

From the bustling city of Columbia to smaller towns across the state, we assist Columbia residents with a variety of insurance claims, including storm damage, fire damage, and water damage. No matter where you are, our team is ready to fight for a fair settlement.

Pennsylvania

From Philadelphia to Pittsburgh, Pennsylvania, homeowners and businesses trust us to handle claims for water damage, winter storm damage, and structural damage. We understand local insurance policies and work tirelessly to help clients recover from property losses.

Oklahoma

Oklahoma’s severe weather, including tornadoes and hailstorms, can cause significant property damage. Our public adjusters specialize in handling claims related to wind damage, hail damage, and flooding, ensuring that homeowners and business owners receive proper compensation.

Know Your Insurance Rights

Many people do not realize that insurance companies often undervalue claims. You do not have to settle for less. Our insurance public adjusters fight to make sure you receive the full compensation you deserve.

What types of storm damage do you handle?

We assist with claims for wind, hail, hurricanes, tornadoes, roof damage, flooding, and other storm-related losses.

How long does the claims process take?

The timeline depends on your case, but we work efficiently to get your settlement as quickly as possible.

What if my insurance claim was denied?

We can review your denied claim, find the issues, and appeal the decision with stronger evidence and negotiation tactics.

Experience & Certifications

Industry Certifications

Independent Adjuster with Authority in 40+ states

Certified Property Appraiser and Umpire Registration # 72550288

Engineer by Education

NFIP Flood Adjuster – Flood Control Number # 0070011826.

IICRC Certified FSRT – Fire and Smoke Damage Restoration Technician

IICRC Certified WTR – Water Damage Restoration Technician

Haag Certified Inspector – Residential Roofs

Haag Certified Inspector – Commerical Roofs

Haag Certified Inspector – Wind Damage

Level I Roof Specific Rope Access Certification

Xactimate L3 Certification

Symbility L2 Certification

Texas Windstorm Insurance Association Field Adjuster Certification

Former Licensed Home Improvement Contractor

State Farm Policy Certification

State Farm Auto Certification

State Farm Estimatics Certification

USAA Adjuster Certification

Industry Experience

500+ Appraisals handled for Policy Holder

350+ Appraisals handled for Carrier (Allstate, Liberty Mutual, Indiana Farmers etc.)

30+ Umpire Assignments

12+ Yrs in Insurance Industry

10+ Yrs as a Corporate Program Manager

5+ Yrs as a Licensed Mitigation Contractor

10 Yrs experience in Gutting Houses and Rebuilding

We work with all insurance companies: We negotiate directly with you insurance so you don’t have to

+ many more...

712% Average Payout Increase:

Get the Full Payment you Deserve

Our public adjusters excel at settling denied claims and increasing settlement amounts for both residential & commercial claims.

Residential Claims

We specialize in helping homeowners with insurance claims, especially when claims are denied or the offered amount isn't enough to cover repairs. Our team works hard to negotiate fair settlements, ensuring homeowners get the money they need to fix their homes.

Commercial Claims

We specialize in commercial insurance claims, when business owners face denials or insufficient offers that can disrupt operations and income. With a team of engineers, adjusters, and estimators, we ensure fair settlements, minimizing business disruptions and financial impacts.

97% Success Rate:

Settle your claim for maximum compensation

On average, our clients receive a 712% larger payout on their insurance claims

With a 97% success rate, our public adjusters excel at settling denied claims and increasing settlement amounts.

Our expertise in thoroughly understanding your policy and providing accurate estimate documentation ensures you receive the compensation you deserve.

This turns frustrating claim rejections into fair and satisfactory outcomes.

Proven Success in Insurance Claims: Real Case Studies, Real Results

Fire Damage

with Travelers

Other Attorney

$214,872

Claim Warriors

$418,317

“Claim Warrior was a lifesaver stepping into navigate the fire damage claim when the insurance representative was unresponsive and evasive.”

Danny A.

Roof Damage

with Progressive

Other Adjuster

$4,295

Claim Warriors

$51,618

“Claim Warrior proved storm damage caused roof issues. countering the insurance claims of contractor error, and getting me a fair settlement to repair my roof.”

John W.

Water Damage

with Allstate

Original Settlement

DENIED

Claim Warriors

$114,473

“Insurance company initially offered too little and didn’t want to pay. Claim Warrior helped me get fair compensation for water damage from a pipe burst.”

Kelly P.

FAQ

When should I hire a public adjuster?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

How does Claim Warrior get paid?

We work on a contingency fee basis, which means we receive a percentage of the final insurance settlement. This fee is agreed upon before they begin work on your claim.

Why should I choose a public adjuster over handling the claim myself?

Public adjusters bring specialized expertise in insurance policies, claims procedures, and negotiation tactics. They can often secure higher settlements than policyholders can negotiate on their own, and they handle all the complexities of the claims process, saving you time and reducing stress.

What if I've already received a settlement offer from my insurance company?

Even if you’ve received a settlement offer, a public adjuster can review it to ensure it adequately covers all damages and losses. They can negotiate with the insurance company for a higher settlement if necessary.

Toll Free +1 (833) 573-9492

© 2025 Independence Claims Services • All Rights Reserved