Independence Claims Success Story: Turning a Denied Roof Claim into a $23,255 Settlement in Bridge City, TX

April 17, 2025

1 min read

Before

After

When a storm damages your home, you expect your insurance to step up. But sometimes, insurance companies fall short—leaving homeowners and contractors frustrated and out-of-pocket. Fortunately, with the right advocate in your corner, even a denied claim can become a success story. Here’s how Independence Claims, working alongside Independence Claims Services, transformed a denied roof claim into a full roof replacement for a Bridge City, TX homeowner and BC Roofing and Restoration.

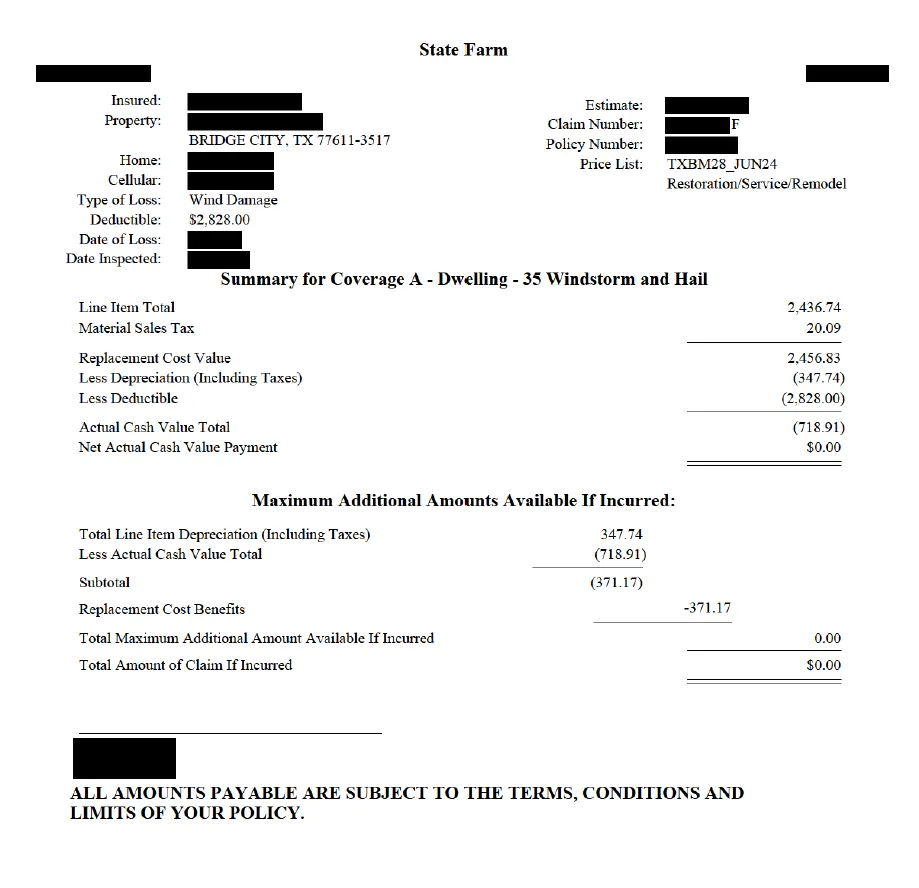

The Challenge: Claim Denied, Damages Downplayed

After a severe storm hit Bridge City, a homeowner turned to their insurer, State Farm, to file a roof damage claim. The result? State Farm’s adjuster estimated the damages at less than $2,500—an amount below the policy deductible. The insurance company paid nothing, leaving the homeowner with extensive damage and no support.

BC Roofing and Restoration, the contractor on the project, knew the damage was far more extensive than the insurance estimate reflected. The homeowner was left in a difficult situation: a damaged roof, a denied claim, and mounting repair costs.

Independence Claims Steps In: Advocacy That Makes a Difference

Not willing to accept the denial, the homeowner reached out to Independence Claims. As experienced public adjusters, Independence Claims specializes in representing policyholders and ensuring fair treatment from insurance companies.

The team at Independence Claims quickly reviewed the file, performed their own inspection, and recognized the carrier’s estimate was nowhere near sufficient. Leveraging their expertise, Independence Claims invoked the appraisal clause in the insurance policy—a powerful tool that allows disputed claims to be resolved by independent professionals.

Partnering with Independence Claims Services: The Appraisal Advantage

To ensure the homeowner received a truly accurate and fair assessment, Independence Claims brought in Independence Claims Services as their chosen appraiser. Independence Claims Services, led by Sarath Jerome, is known for their thorough documentation, deep industry expertise, and commitment to policyholders.

Together with the carrier’s appraiser, Independence Claims Services conducted a comprehensive on-site inspection. Their process included:

Detailed Documentation: Accurate measurements, extensive photographs, and a review of all affected areas.

In-Depth Damage Assessment: Evaluating not just the roof but all related structural issues, code requirements, and hidden damages.

Expert Estimating: Utilizing Xactimate and Symbility to ensure every repair and replacement was accounted for—no shortcuts, no overlooked details.

The Turnaround: From Denial to Full Settlement

Thanks to the diligence and collaboration between Independence Claims and Independence Claims Services, the appraisal moved quickly. Within just two weeks of the joint inspection, the two appraisers reached a fair and final agreement: a full roof replacement, with a total settlement of $23,255.92.

What started as a denied claim with zero payout was transformed into a complete, top-quality roof replacement—fully covered by insurance.

Why Independence Claims Makes the Difference

This story is proof that policyholders don’t have to accept an insurance company’s first answer. With Independence Claims on your side, you get:

Expert Advocacy: Independence Claims fights for you, not the insurance company.

Thorough Investigation: Every claim is reviewed with a fine-tooth comb—no detail missed, no damage ignored.

Industry Partnerships: By working with trusted appraisal experts like Independence Claims Services, Independence Claims ensures every client gets the best possible outcome.

Faster, Fairer Results: The appraisal process, when handled by professionals, delivers fast, binding settlements that reflect the true cost of repairs.

Why Independence Claims Makes the Difference

For BC Roofing and Restoration, Independence Claims’ work ensured their client could move forward with a full roof replacement, confident in both the quality of the work and the fairness of the settlement. For the homeowner, it meant peace of mind and financial relief—proof that with the right team, denied claims can be overturned.

Your Advocate for Every Claim

At Independence Claims, we believe every policyholder deserves a fair shake. If you’re facing a denied or underpaid claim, don’t go it alone—let our experienced team fight for you. From initial review to final settlement, we’re with you every step of the way.

Contact Independence Claims today and discover how we turn denied claims into success stories.

Independence Claims Success Story: Turning a Partial Denial Into a Real Recovery in Denver, CO

April 17, 2025

1 min read

Before

After

When a hailstorm hit Denver, CO, in late May 2024, one local homeowner found themselves facing not only property damage but also the daunting process of dealing with their insurance company. Like many, they expected their insurance policy to help them bounce back. What happened next could have left them with a major financial gap—if not for the advocacy and expertise of Independence Claims.

The Challenge: A Partial Denial and a Low Payout

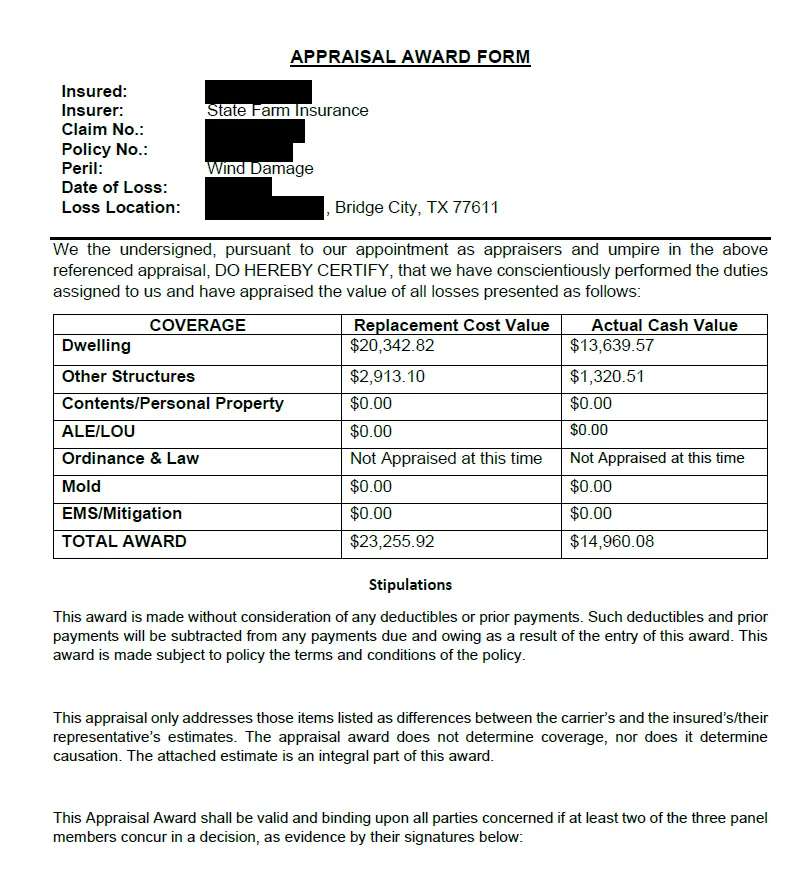

After promptly filing a claim with American Economy Insurance Company for hail damage, the homeowner received a letter they hadn’t expected. The insurer acknowledged some coverage for hail-related damage but denied coverage for “mechanical damage,” citing policy exclusions like wear and tear, deterioration, and inherent defects.

Here’s how the numbers broke down in the insurance letter:

Dwelling Damage Payment: $5,766.02

Deductible: -$2,500.00

Recoverable Depreciation: -$542.18

Paid When Incurred: -$216.66

Net Payment: $2,507.18

For this homeowner, the partial coverage and low payout meant being left with a significant gap between what the insurer would pay and what it would actually cost to restore the home.

Independence Claims Steps In

Knowing they needed help, the homeowner reached out to Independence Claims, hoping for guidance and a second opinion. Our team immediately took action:

Policy Review: We carefully reviewed the policy and the insurer’s denial letter, pinpointing areas where the claim may have been underestimated or unfairly denied.

Damage Assessment: Our experts conducted a thorough inspection of the hail damage, documenting every detail with photos and contractor estimates.

Client Advocacy: We explained the homeowner’s rights under their policy, including the ability to dispute the insurer’s findings and pursue a fair settlement.

The Independence Claims Difference: Advocacy in Action

With Independence Claims by their side, the homeowner didn’t have to navigate the confusing world of insurance alone. We handled the back-and-forth with the insurer, provided the evidence needed to support the claim, and pushed for a full and fair settlement.

Our approach included:

Clear Communication: We kept the homeowner informed at every step, answering questions and setting realistic expectations.

Persistent Negotiation: We challenged the insurer’s initial findings, using our expertise to demonstrate the true extent of the hail damage and the real cost of repairs.

Comprehensive Documentation: Our team provided detailed reports, photographs, and contractor estimates that left no doubt about the necessary scope of work.

The Outcome: Peace of Mind Restored

Thanks to Independence Claims’ advocacy, the homeowner was empowered to challenge their partial denial and pursue the recovery they truly needed. Instead of settling for a low payout and unfinished repairs, they were able to secure the resources required to restore their home.

Why Homeowners Trust Independence Claims

This story is one of many. Here’s what makes working with Independence Claims different:

We’re on Your Side: We work for policyholders, not the insurance company.

We Know the System: Our team understands both the policy language and the realities of property damage.

We’re Relentless: We don’t give up until you get the fair treatment and settlement you deserve.

Don’t Settle for Less Than You Deserve

If you’ve received a partial denial, a lowball offer, or just feel overwhelmed by the insurance process, you’re not alone. Independence Claims is here to help you get back on your feet—just like we did for this Denver homeowner.

Contact us today for a free claim review, and let’s make your recovery story a success!

Independence Claims Success Story: Turning a Denied Roof Claim into a $20,466 Settlement for Christophen Schexnider in Bridge City, TX

April 17, 2025

1 min read

Before

After

When a storm damages your home, you expect your insurance company to help you rebuild. But what happens when your claim is denied or drastically underpaid? For Christophen Schexnider, a Bridge City, TX homeowner, that’s exactly what happened—until Independence Claims stepped in and turned the situation around. Here’s how our team, in partnership with Independence Claims Services, transformed a denied claim into a full roof replacement and peace of mind.

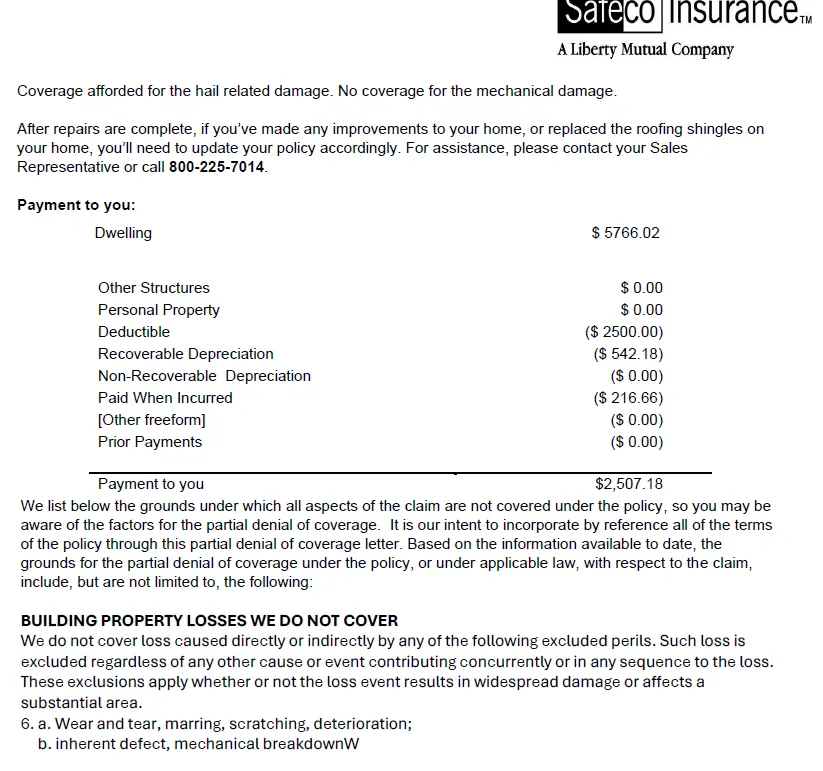

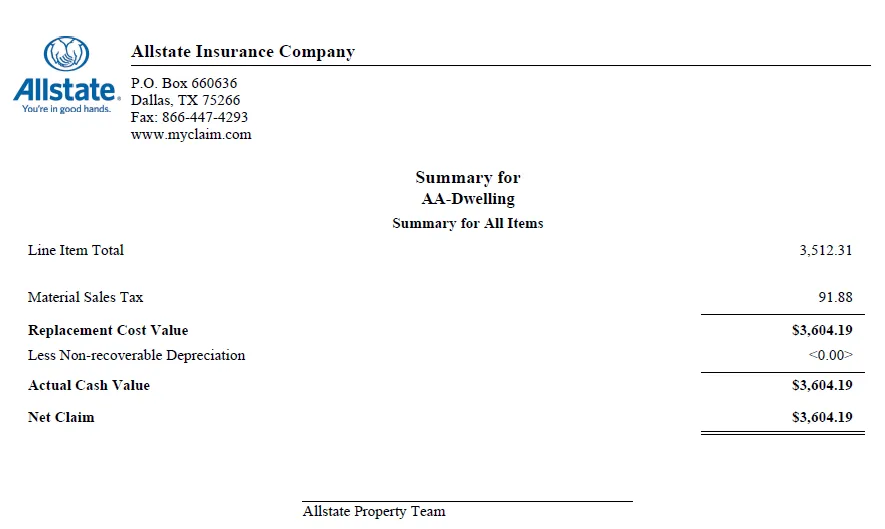

The Setback: Allstate Denies the Claim

After a severe storm left Christophen’s roof battered, he did what any homeowner would do—he filed a claim with his insurance provider, Allstate. But after their inspection, Allstate estimated the damages at just $3,604.19, an amount that wouldn’t even begin to cover the cost of repairs. The claim was essentially denied, leaving Christophen facing a damaged home and no meaningful support from his insurer.

For BC Roofing and Restoration, the trusted contractor on the project, it was clear that the roof had suffered significant damage—far more than what Allstate acknowledged. Christophen was left with a difficult decision: accept the insurance company’s assessment and pay out of pocket, or fight for the coverage he deserved.

Independence Claims Steps In: Advocacy for the Policyholder

Refusing to accept the insurance company’s verdict, Christophen turned to Independence Claims. As experienced public adjusters, our mission is to represent policyholders—not insurance carriers—and to fight for fair, accurate settlements.

Our first step was to conduct a thorough review of Allstate’s estimate and perform our own inspection of the property. It was immediately clear that the initial assessment was incomplete and didn’t reflect the true scope of the damage. We knew Christophen deserved better.

Invoking Appraisal: A Path to Fair Resolution

With the evidence in hand, Independence Claims invoked the appraisal clause in Christophen’s insurance policy. The appraisal process is a powerful tool that allows disputed claims to be reviewed by independent, unbiased experts—often resulting in a faster, fairer outcome without the need for litigation.

To ensure the best possible result for Christophen, we brought in Independence Claims Services as our chosen appraiser. Their reputation for thorough inspections, detailed documentation, and industry expertise made them the perfect partner for this case.

Detailed Documentation: Accurate measurements, extensive photographs, and a review of all affected areas.

In-Depth Damage Assessment: Evaluating not just the roof but all related structural issues, code requirements, and hidden damages.

Expert Estimating: Utilizing Xactimate and Symbility to ensure every repair and replacement was accounted for—no shortcuts, no overlooked details.

The Appraisal Process: Teamwork and Expertise

Once the appraisal process was underway, Independence Claims Services coordinated with the appraiser appointed by Allstate. Together, they scheduled a joint inspection of Christophen’s property.

Independence Claims Services approached the inspection with meticulous attention to detail, including:

Comprehensive Documentation: Every aspect of the damaged roof was measured, photographed, and assessed, ensuring nothing was missed.

In-Depth Damage Assessment: The inspection included a review of the roof’s structure, underlayment, decking, and any signs of water intrusion.

Industry-Leading Tools: Advanced estimating platforms like Xactimate and Symbility were used to accurately account for all necessary repairs and replacements.

Code Compliance: Local building codes and manufacturer requirements were factored into the estimate, guaranteeing the replacement would meet all standards.

Throughout the process, Independence Claims stayed in close communication with Christophen and BC Roofing and Restoration, keeping them informed and confident that their interests were being protected.

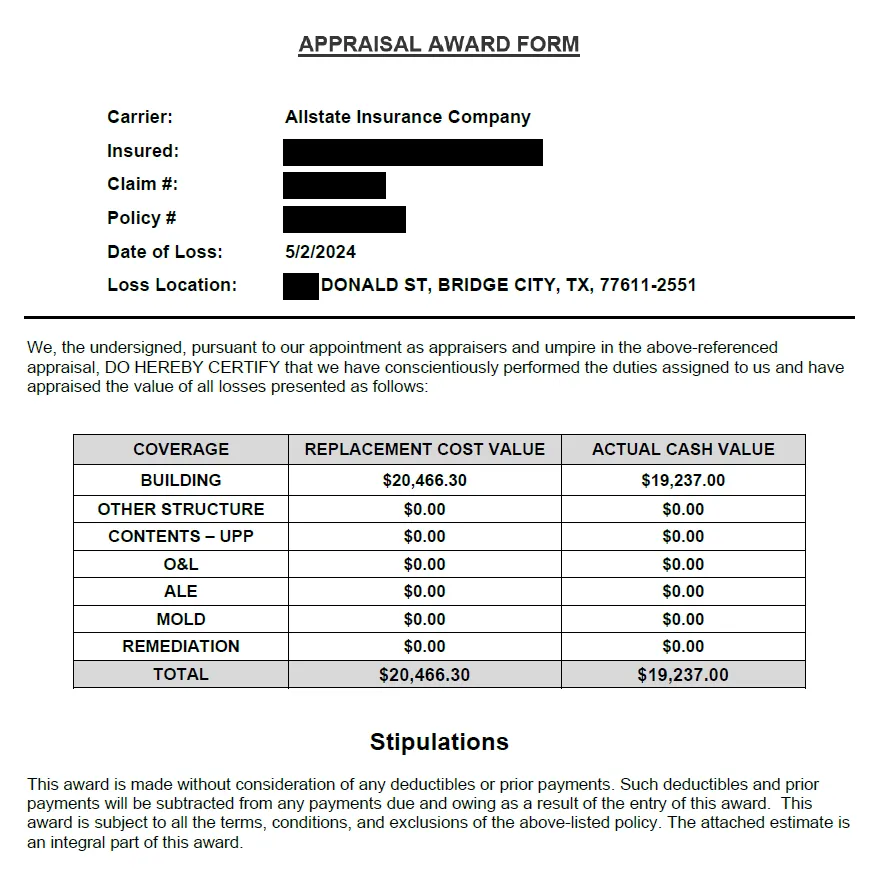

The Result: A Settlement That Reflects Reality

Thanks to the diligence and expertise of Independence Claims and Independence Claims Services, the appraisal process moved quickly. Within just two weeks of the joint inspection, both appraisers reached a binding agreement: Christophen would receive a settlement of $20,466.30—enough for a full roof replacement.

A claim that began with a denial and a lowball estimate ended in a fair, comprehensive settlement. Christophen could finally move forward, knowing his home was protected and his investment secured.

Why Independence Claims Makes the Difference

Christophen’s story is a powerful reminder that policyholders don’t have to accept an insurance company’s first answer. With Independence Claims on your side, you get:

Expert Advocacy: We fight for you, not the insurance company.

Thorough Investigation: Every claim is reviewed in detail, with no damage overlooked.

Industry Partnerships: By working with trusted appraisal experts like Independence Claims Services, we ensure our clients get the best possible outcome.

Faster, Fairer Results: The appraisal process, when handled by professionals, delivers quick, binding settlements that reflect the real cost of repairs.

The Impact: Restoring Homes and Rebuilding Trust

For BC Roofing and Restoration, the successful outcome meant they could move forward with a full roof replacement, delivering quality workmanship and peace of mind to their client. For Christophen Schexnider, it meant relief, security, and the assurance that his insurance policy delivered when it mattered most.

But the impact goes beyond a single claim. Each success story like this strengthens the reputation of public adjusters, contractors, and appraisal firms who put policyholders first. It also underscores the value of having a knowledgeable, certified, and persistent team on your side when navigating the complex world of insurance claims.

Write Your Own Success Story with Independence Claims

At Independence Claims, our mission is to help homeowners, contractors, and public adjusters turn denied and underpaid claims into stories of success. We combine technical expertise, industry certifications, and a commitment to fairness in every case we handle.

If you or your clients are facing a dispute with an insurance company—don’t settle for less than you deserve. Trust the experts who deliver results.

Contact Independence Claims today and let us help you achieve the outcome you deserve.

Independence Claims Success Story: From $2,274 Estimate to $19,663 Award in Valparaiso, IN

April 17, 2025

1 min read

Before

After

When disaster strikes, you deserve more than just a quick insurance check—you deserve a real recovery. That’s exactly what Independence Claims delivered for Sarah of Valparaiso, IN, when her original insurance estimate didn’t even come close to covering the damage. Here’s how our advocacy helped Sarah turn a frustrating claim into a true win.

The Challenge: A Storm, a Claim, and a Disappointing Estimate

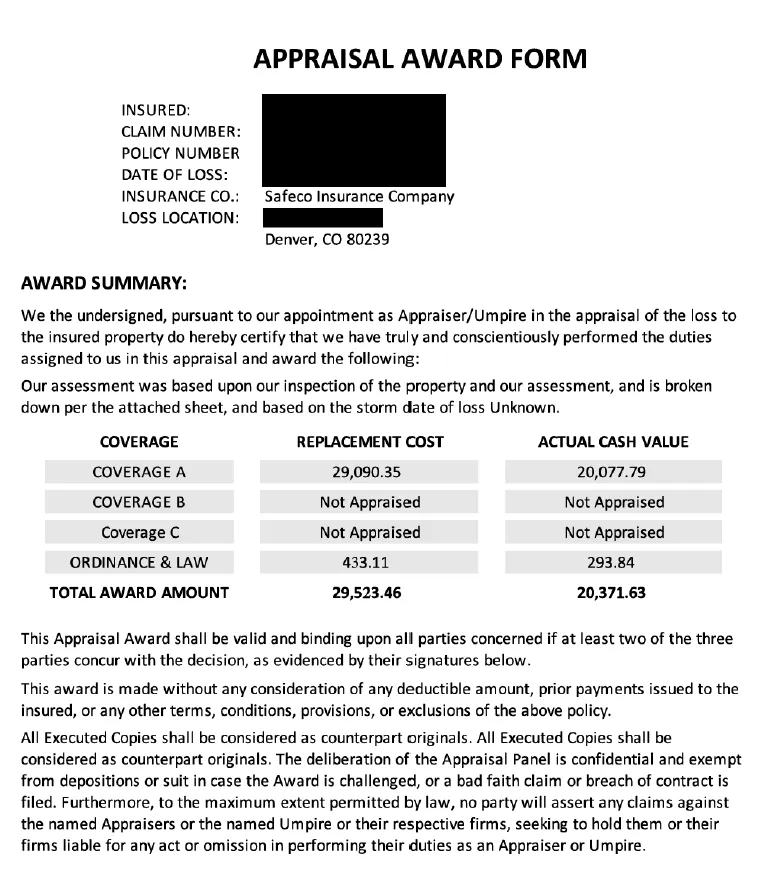

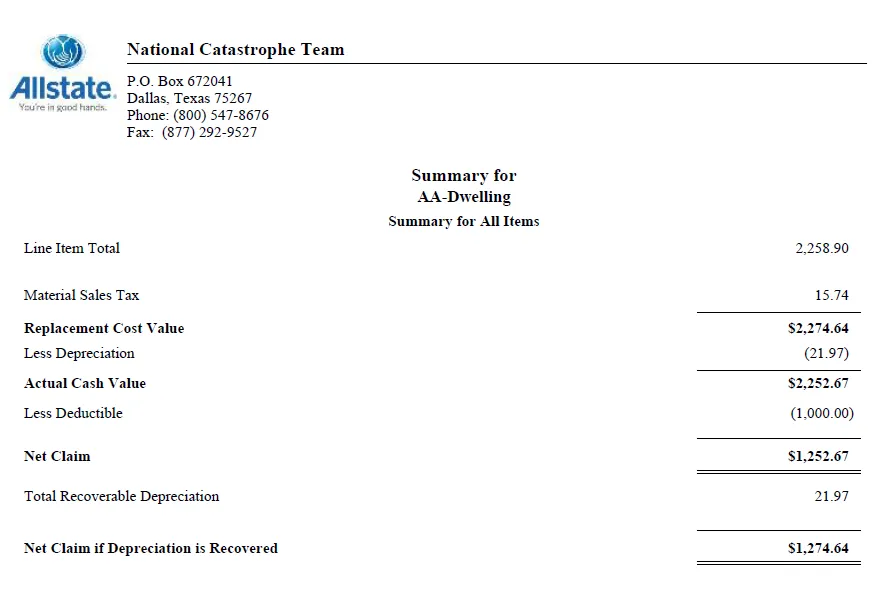

On May 7, 2024, a windstorm and hailstorm damaged Sarah’s home at 375 Stonehill Dr. Like any proactive homeowner, Sarah filed a claim with Allstate, expecting her policy to provide real protection. But after the inspection, the insurance estimate for repairs was just $2,274.64 (Replacement Cost Value)—barely enough for temporary repairs and minor fixes.

After depreciation and her deductible, Sarah was left with a net claim of just $1,252.67. That wouldn’t even scratch the surface of what it would take to restore her home.

Independence Claims Steps In

Sarah knew she needed someone on her side who understood both insurance and construction. That’s when she called Independence Claims. Our team listened to her concerns, reviewed all the paperwork, and explained her rights—including the powerful appraisal process built into most policies.

We got to work documenting every detail, gathering photos, and building a comprehensive estimate of what it would really take to repair her home. Then, we invoked the appraisal clause, which brings in independent experts to determine a fair settlement.

The Appraisal Process: Advocacy in Action

Independence Claims represented Sarah every step of the way. We made sure nothing was missed, presented clear evidence, and negotiated persistently with the insurance company’s appraiser. We made it our mission to ensure Sarah’s voice was heard and her loss was fully recognized.

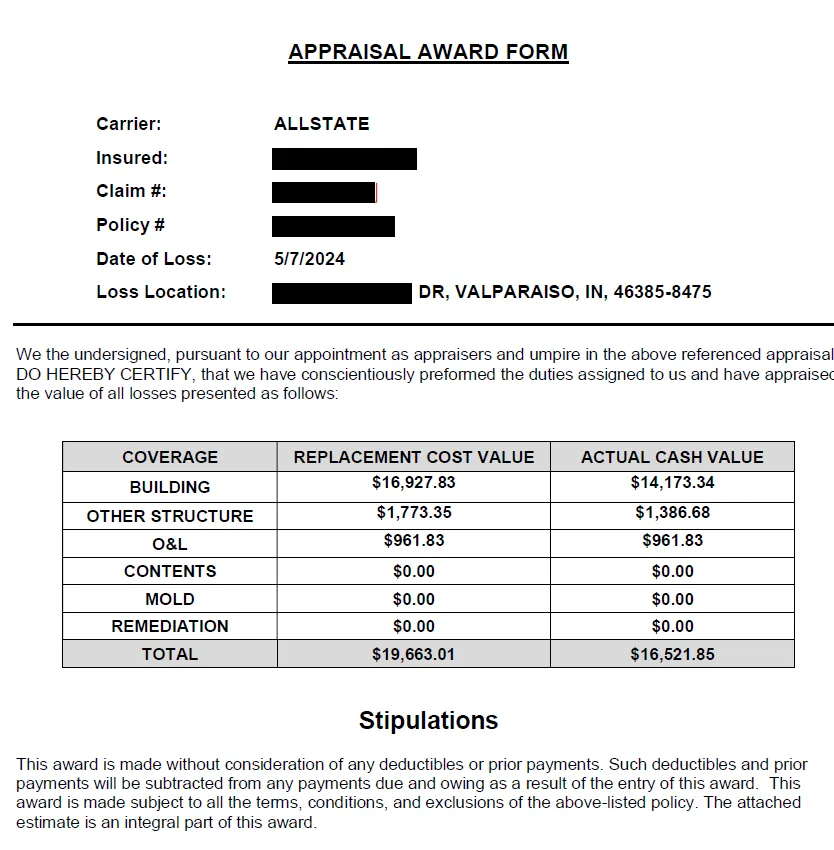

After a thorough review, the appraisal panel reached a fair and honest award:

Building Replacement Cost Value: $16,927.83

Other Structure: $1,773.35

Ordinance & Law (O&L): $961.83

Total Appraisal Award: $19,663.01

That’s nearly NINE TIMES the original insurance estimate!

The Outcome: Real Recovery, Real Peace of Mind

Thanks to Independence Claims, Sarah can now restore her home completely—without worrying about out-of-pocket costs or unfinished repairs. Our expertise and dedication ensured she received every dollar she was owed under her policy.

Why Choose Independence Claims?

Sarah’s story is just one example of how we help homeowners every day:

We understand insurance and construction inside and out.

We handle the paperwork, negotiation, and advocacy for you.

We’re relentless about getting our clients what they truly deserve.

We turn lowball offers into real recoveries.

Don’t Settle for Less Than You Deserve

If you’re facing a low insurance offer after storm damage, don’t give up. Independence Claims will review your claim, explain your options, and fight for the settlement you need to truly recover.

Contact us today and let’s turn your claim into your own success story—just like we did for Sarah!

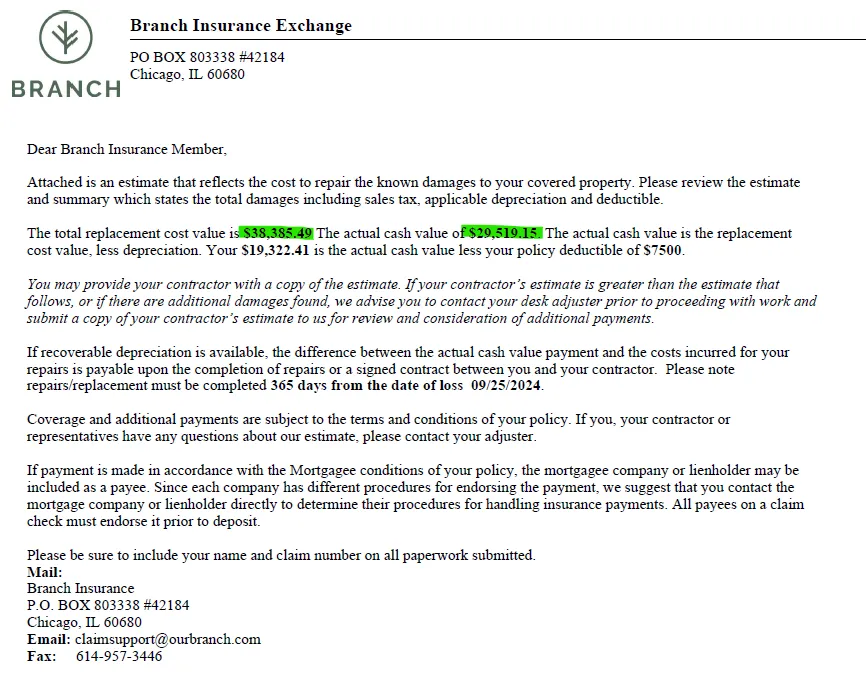

Independence Claims Success Story: Turning a Branch Insurance Denial into a $38,385 Roof Approval in Frisco, TX

April 17, 2025

1 min read

Before

After

When a storm damages your home, your insurance policy should provide peace of mind. But what happens when your claim is denied, and you’re left staring at a damaged roof with no support? For one Frisco, TX homeowner, that scenario became a reality—until Independence Claims stepped in and changed the outcome entirely. Here’s the story of how our team transformed a denied claim from Branch Insurance into a $38,385.49 roof approval, restoring both the property and our client’s confidence in the claims process.

The Setback: Branch Insurance Denies the Claim

It began like so many insurance stories do: a severe weather event left a Frisco homeowner’s roof battered and leaking. The homeowner, acting quickly and responsibly, filed a claim with their insurer, Branch Insurance. But after their inspection, Branch Insurance delivered a disheartening verdict—the claim was denied. According to their assessment, the damage either didn’t meet the threshold for coverage or wasn’t sufficiently documented to warrant a payout.

For the homeowner, this was more than just a financial setback. Their property was exposed to further damage, and their trust in the insurance process was shaken. The denial left them with a difficult choice: pay out of pocket for costly repairs, or fight back and risk a long, stressful battle with their insurer.

Independence Claims Steps In: Advocacy and Expertise

Refusing to let the denial stand, the homeowner reached out to Independence Claims. As experienced public adjusters, our mission is to advocate for policyholders—not insurance companies—and ensure that every client receives a fair and accurate settlement.

Our first step was to conduct a thorough, independent inspection of the Frisco property. Unlike a rushed or cursory review, our inspection was comprehensive and meticulous. We:

Documented Every Detail: We measured, photographed, and noted every area of roof damage, from missing shingles to compromised underlayment and flashing.

Evaluated Hidden Issues: We looked for signs of water intrusion, structural impact, and code compliance issues that might not be visible to the untrained eye.

Reviewed the Policy: We examined the homeowner’s insurance policy to ensure that all covered damages were properly identified and included in our assessment.

The Power of Documentation: Building a Rock-Solid Case

One of the most common reasons insurance claims are denied or underpaid is a lack of thorough documentation. At Independence Claims, we know that the key to a successful claim—especially a reopened one—is ironclad evidence.

We compiled a detailed report that included:

High-resolution photos, with date and location stamps

Precise measurements and diagrams of the affected areas

A written narrative describing the storm event, the resulting damage, and the necessity of a full roof replacement

References to local building codes and manufacturer guidelines that supported the need for a complete restoration

Our documentation didn’t just tell a story—it proved it, beyond any reasonable doubt.

Submitting the Reopen Request: Persistence Pays Off

Armed with our comprehensive report, we submitted a formal reopen request to Branch Insurance. We clearly outlined the discrepancies in the initial denial, provided new evidence, and made a compelling case for why the claim should be reconsidered.

Throughout the process, we communicated directly with both the homeowner and Branch Insurance, ensuring transparency and keeping everyone informed. Our goal wasn’t just to challenge the denial, but to work collaboratively with the insurer to reach a fair resolution.

The Reinspection: Setting the Record Straight

Branch Insurance responded to our request by scheduling a reinspection at the Frisco property. This time, our team was present to walk the adjuster through every detail of our findings. We explained the extent of the storm damage, demonstrated areas that had been missed or underestimated in the initial inspection, and answered every question with clarity and professionalism.

Having a knowledgeable advocate on-site made all the difference. We were able to highlight not only the visible damage but also the underlying issues that justified a full roof replacement.

The Turnaround: Full Roof Approval and a $38,385.49 Settlement

The results spoke for themselves. After the reinspection and a thorough review of our documentation, Branch Insurance reversed their initial denial. The claim was approved in full, with a settlement of $38,385.49—enough to cover a complete roof replacement and restore the Frisco property to pre-loss condition.

For the homeowner, it was a life-changing result. What began as a denied claim and a looming financial burden ended with a fair settlement and the peace of mind that comes from knowing their home was protected.

Why Independence Claims Makes the Difference

This story is a testament to the power of persistence, expertise, and advocacy in the claims process. Here’s what sets Independence Claims apart:

We Fight for Policyholders: Our sole focus is on representing your interests, not the insurance company’s bottom line.

We Leave No Stone Unturned: Our inspections and reports are exhaustive, ensuring that every covered loss is identified and documented.

We Understand the System: We know how insurance policies work, and we use that knowledge to advocate effectively for our clients.

We Communicate Clearly: From start to finish, we keep you informed and empowered, so you never feel alone in the process.

We Get Results: Our track record speaks for itself—time and again, we turn denials and underpayments into fair, full settlements.

The Impact: Restoring Homes and Rebuilding Trust

For this Frisco homeowner, the successful resolution meant more than just a new roof—it restored their trust in the insurance process and gave them the security they needed to move forward. For us at Independence Claims, it was another opportunity to make a meaningful difference in a client’s life.

But the impact goes beyond a single claim. Every success story like this one strengthens our commitment to helping homeowners, contractors, and communities get the support they deserve when disaster strikes.

Write Your Own Success Story with Independence Claims

If you’ve had a claim denied or underpaid—or if you simply want the peace of mind that comes with having an expert on your side—don’t hesitate to reach out. At Independence Claims, we’re here to fight for you, every step of the way.

Contact Independence Claims today and let us help you turn your insurance challenge into a success story.

Independence Claims Success Story: Securing a Fair Roof Settlement After Hail Damage in Lansing, IL

April 17, 2025

1 min read

At Independence Claims, our mission is simple but powerful: we stand shoulder-to-shoulder with policyholders, ensuring they receive the fair outcomes they deserve—especially when insurance companies fall short. Every claim is a story, and some truly showcase the difference that expert advocacy makes. Our recent victory in Lansing, Illinois is a perfect example—demonstrating how persistence, experience, and the right strategy can turn a disputed claim into a meaningful recovery.

The Hailstorm That Started It All

Spring storms in the Midwest are no joke. In early April 2025, Lansing, IL was hit by a severe hailstorm, leaving a trail of damage across the neighborhood. For our client, the aftermath was clear: hail strikes riddled the roof, shingles were compromised, and water intrusion was a looming threat. Like any responsible homeowner, they filed a claim with their insurance carrier, Allstate, expecting their long-standing policy to provide the protection they needed.

But as is all too common, the initial response from the insurer left much to be desired. The insurance company’s assessment didn’t come close to covering the real cost of repairs. The payout offered wouldn’t restore the property to its pre-storm condition—leaving our client frustrated, anxious, and unsure where to turn.

Independence Claims Steps In: Advocacy from Day One

Instead of accepting the low offer or paying out of pocket, the homeowner reached out to Independence Claims. Our first priority? Listening. We took the time to understand the details of the loss, review the denial letter, and answer every question. We know how overwhelming the claims process can feel, and we’re here to guide our clients every step of the way.

From the outset, we explained the appraisal process and set clear expectations. Our strategy was simple: build an ironclad case, advocate relentlessly, and leave no stone unturned.

Building a Bulletproof Appraisal Package

The foundation of any successful claim is documentation. At Independence Claims, we believe meticulous preparation is non-negotiable. Here’s how we approached this case:

1. Comprehensive Inspection

We performed a thorough, on-site inspection of the Lansing property. Our adjusters examined every square foot of the roof, looking for:

Hail impact marks on shingles and vents

Granule loss and exposed fiberglass

Damaged flashing and compromised seals

Potential water intrusion points

Hidden structural issues beneath the surface

2. Partnering with Trusted Experts

To ensure accuracy and credibility, we partnered with Iron Guys Roofing, a reputable local contractor. Their detailed estimate left nothing to chance, covering not just the visible damage but also code-required upgrades and underlying repairs.

3. Clear, Organized Documentation

We assembled a comprehensive appraisal package, including:

A line-by-line estimate totaling $35,863.06

High-resolution, time-stamped photos

Diagrams and measurements of all affected areas

A written narrative tying the storm event to the current condition

References to local building codes and manufacturer guidelines

This package was submitted to Allstate on April 8th, 2025—leaving no doubt about the extent and cause of the damage.

Invoking the Appraisal Clause: Leveling the Playing Field

Many homeowners don’t realize their insurance policy includes an appraisal clause—a powerful tool for resolving disputes over the value of a loss. It’s not a lawsuit; instead, both sides select their own appraiser, and if needed, an impartial umpire decides the outcome. This process is faster, less adversarial, and binding.

With our documentation in hand, we formally demanded appraisal. Allstate responded promptly, naming their own appraiser by April 10th. The stage was set for a fair, independent review.

The Joint Inspection: Advocacy in Action

On April 24th, both appraisers met at the Lansing property for a joint inspection. This was a pivotal moment. Independence Claims was there to:

Walk the property with Allstate’s appraiser

Highlight every hail strike, damaged shingle, and code violation

Explain why certain repairs wouldn’t suffice, and why full replacement was necessary

Provide supporting evidence for every claim

Our approach was professional and collaborative, but we never wavered in our advocacy. We know the process inside and out, and we’re skilled at bridging the gap between what’s “good enough” for the insurer and what’s truly right for the homeowner.

Negotiation and Resolution: The Power of Experience

Appraisal isn’t just about presenting facts—it’s about negotiation, expertise, and understanding policy language. Over the next week, Independence Claims and Allstate’s appraiser exchanged findings and worked through discrepancies.

We addressed every concern with data, logic, and transparency. Our deep knowledge of construction standards, insurance policy wording, and local codes gave us the credibility to push for a fair settlement.

By May 2nd, 2025, the process concluded with a binding agreement: a final replacement cost value (RCV) of $32,864.11. While slightly less than the original estimate, it was a substantial recovery—far exceeding Allstate’s initial offer and fully enabling our client to restore their home.

The Outcome: Restoring Homes and Rebuilding Trust

For our client, this wasn’t just about a roof. It was about protecting their investment, maintaining their property value, and regaining peace of mind. The fair settlement meant they could hire reputable contractors, use quality materials, and ensure the repairs met all building codes.

For Independence Claims, it was another mission accomplished. We had helped a homeowner navigate a complex process, overcome an undervalued claim, and achieve a just outcome—without the stress, expense, or delay of litigation.

Why Independence Claims Makes the Difference

This Lansing, IL case is more than just a win. It’s a blueprint for how we serve every client:

1. We Represent Only Policyholders

Our loyalty is never divided. We work for you, not the insurance company, and our compensation is tied to your success.

2. Unmatched Technical Expertise

Our team combines years of claims adjusting experience with real-world construction knowledge. We know what damage looks like, how it should be repaired, and what it truly costs.

3. Meticulous Documentation

Every claim is supported by detailed estimates, photos, and code references. This thoroughness leads to faster, more favorable outcomes.

4. Professionalism and Integrity

We treat every party with respect. Our reputation for fairness means carriers take our cases seriously.

5. Clear Communication

We keep clients informed, explain every step, and are always available to answer questions.

6. Proven Results

Our track record speaks for itself. We routinely secure settlements far above initial insurance offers.

The Bigger Picture: Empowering Homeowners Across Illinois

The Lansing success story is just one example of the impact Independence Claims makes every day. More and more homeowners are discovering that they don’t have to accept an insurance company’s first answer. With the right advocate, the appraisal clause becomes a powerful tool for justice.

Whether you’re facing hail, wind, fire, or water damage—if your claim is underpaid or denied, we’re ready to help.

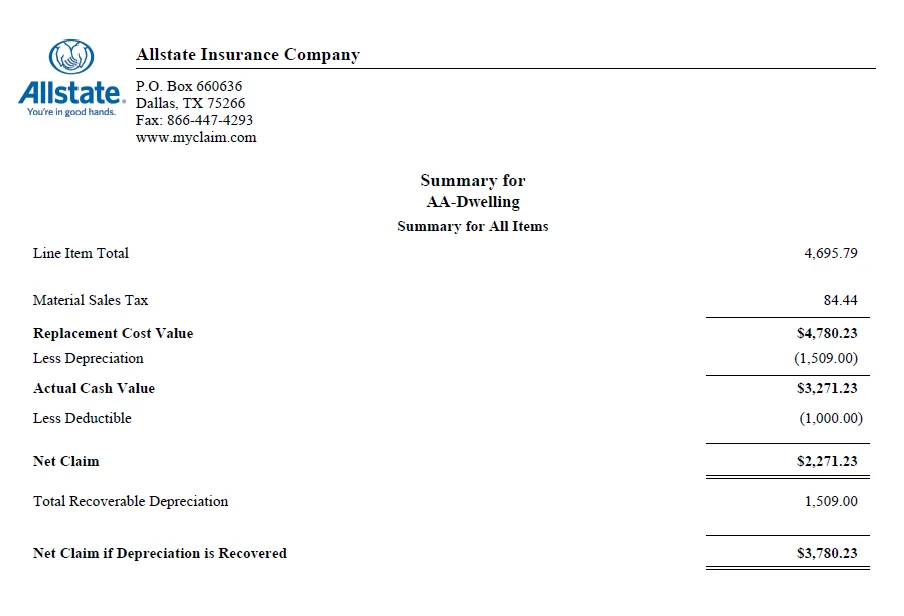

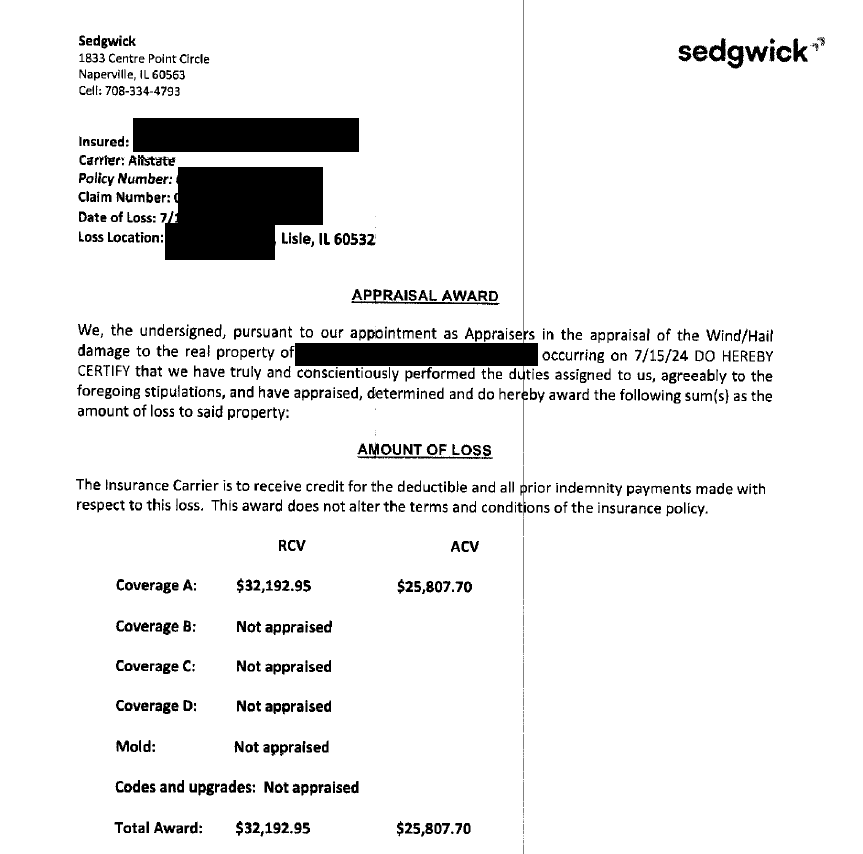

Independence Claims Success Story: How Wendy Got the Full Coverage She Deserved in Lisle, IL

April 17, 2025

1 min read

Before

After

At Independence Claims, we believe every homeowner deserves a fair shake—especially after a storm turns life upside down. That’s why we’re so excited to share Wendy Caldwell’s story from Lisle, IL. With a little help from our team, Wendy turned a disappointing insurance estimate into a settlement that truly covered her needs. Here’s how it all happened!

When the Storm Hit: A Rough Start

Last July, a wild windstorm and hail swept through Lisle, IL, leaving Wendy Caldwell’s home battered—her roof and gutters took the brunt of it. Like any responsible homeowner, Wendy quickly filed a claim with Allstate, hoping her policy would help her bounce back.

But after the adjuster’s visit, Wendy was stunned by the numbers she saw:

Replacement Cost Value (RCV): $4,780.23

Actual Cash Value (ACV): $3,271.23

Net Claim (after deductible): $2,271.23

That just wasn’t going to fix the damage. The estimate barely covered the basics, and certainly not the full repairs her home needed.

Enter Independence Claims: Your Friendly Neighborhood Advocates

Wendy wasn’t ready to settle for less, and neither were we. When she reached out to Independence Claims, we listened to her story, looked over all the paperwork, and knew right away she deserved better.

We explained her options and let her know about something called the “appraisal process”—a built-in protection in most insurance policies for times just like this. Think of it like a second opinion, where both sides bring in their own experts to figure out what’s fair.

Making the Case: Thorough, Honest, and On Your Side

Our team got to work right away:

We gathered every bit of evidence—photos, contractor estimates, and a detailed rundown of all the storm’s impact.

We represented Wendy during the joint inspection, making sure nothing was missed and every detail was explained.

And we negotiated persistently, always with Wendy’s best interest at heart.

The Happy Ending: From Lowball to Life-Changing

After the appraisal process played out, the final award was a game-changer:

Final Appraisal Award (RCV): $32,864.11

That’s more than six times the original insurance estimate! Wendy could finally get her roof and gutters fully repaired—no shortcuts, no stress, and no out-of-pocket surprises.

Why Choose Independence Claims?

Wendy’s story is proof that you don’t have to take “no” (or “not enough”) for an answer. Here’s what makes working with us different:

We’re thorough: Every claim gets the attention it deserves, from documentation to negotiation.

We know our stuff: Our adjusters understand both the insurance world and what it really takes to fix a home.

We keep you in the loop: No confusing jargon or radio silence—we’re here to answer questions and keep things moving.

We fight for you: We’re relentless when it comes to getting our clients what they’re owed.

A Note to Our Neighbors in Lisle, IL

If you ever find yourself in Wendy’s shoes—storm damage, a low insurance offer, and feeling stuck—don’t worry. You have options, and you don’t have to go through it alone. The appraisal process is your right, and with Independence Claims, you’ve got a friendly and experienced team in your corner.

Let’s turn your insurance headache into a success story. Reach out to Independence Claims today and let’s get you the recovery you truly deserve—just like we did for Wendy!

We work with all insurance companies: We negotiate directly with you insurance so you don’t have to

+ many more...

712% Average Payout Increase:

Get the Full Payment you Deserve

Our public adjusters excel at settling denied claims and increasing settlement amounts for both residential & commercial claims.

Residential Claims

We specialize in helping homeowners with insurance claims, especially when claims are denied or the offered amount isn't enough to cover repairs. Our team works hard to negotiate fair settlements, ensuring homeowners get the money they need to fix their homes.

Commercial Claims

We specialize in commercial insurance claims, when business owners face denials or insufficient offers that can disrupt operations and income. With a team of engineers, adjusters, and estimators, we ensure fair settlements, minimizing business disruptions and financial impacts.

97% Success Rate:

Settle your claim for maximum compensation

On average, our clients receive a 712% larger payout on their insurance claims

With a 97% success rate, our public adjusters excel at settling denied claims and increasing settlement amounts.

Our expertise in thoroughly understanding your policy and providing accurate estimate documentation ensures you receive the compensation you deserve.

This turns frustrating claim rejections into fair and satisfactory outcomes.

Proven Success in Insurance Claims: Real Case Studies, Real Results

Fire Damage

with Travelers

Other Attorney

$214,872

Claim Warriors

$418,317

“Claim Warrior was a lifesaver stepping into navigate the fire damage claim when the insurance representative was unresponsive and evasive.”

Danny A.

Roof Damage

with Progressive

Other Adjuster

$4,295

Claim Warriors

$51,618

“Claim Warrior proved storm damage caused roof issues. countering the insurance claims of contractor error, and getting me a fair settlement to repair my roof.”

John W.

Water Damage

with Allstate

Original Settlement

DENIED

Claim Warriors

$114,473

“Insurance company initially offered too little and didn’t want to pay. Claim Warrior helped me get fair compensation for water damage from a pipe burst.”

Kelly P.

FAQ

When should I hire a public adjuster?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

How does Claim Warrior get paid?

We work on a contingency fee basis, which means we receive a percentage of the final insurance settlement. This fee is agreed upon before they begin work on your claim.

Why should I choose a public adjuster over handling the claim myself?

Public adjusters bring specialized expertise in insurance policies, claims procedures, and negotiation tactics. They can often secure higher settlements than policyholders can negotiate on their own, and they handle all the complexities of the claims process, saving you time and reducing stress.

What if I've already received a settlement offer from my insurance company?

Even if you’ve received a settlement offer, a public adjuster can review it to ensure it adequately covers all damages and losses. They can negotiate with the insurance company for a higher settlement if necessary.

Toll Free +1 (833) 573-9492

© 2025 Independence Claims Services • All Rights Reserved